It’s that time of the year again—The Taxman Cometh! At the end of every financial year, the only question that lurks in the mind of millions of taxpayers is— when is the last day to file taxes? While the very thought of gathering all financial documents may seem to be a daunting process, it doesn’t have to be. With a little preparation and organization, you can breeze through the tax deadline and avoid any last-minute stress.

Whether you are a seasoned pro or a first-time filer, this guide will provide you with everything you need to know to prepare yourself for filing taxes. From important IRS tax deadlines to deductions and credits, you may be eligible for. So, grab a cup of coffee, get your documents in order, and let’s dive into the world of taxes!

- Tax Deadline Looms: Are You Ready? The Race Against Time for Taxpayers!

- Income Tax Filing Deadline for Those Without Employers Withholding Taxes

- IRS Options to Make your Tax Filing a Smooth Process Before the Last date to File Taxes.

- Crucial Dates for Estimated Deadline for Taxes

- Know Your State’s Tax Deadline Dates

- The Cost of Procrastination: Exploring the Consequences of Missing your Last Date to File Taxes

- Best IRS Methods to File Your Taxes on Time and Before the Last Date to File Taxes.

- Don’t Wait Until the Last Minute: Meet the IRS Tax Deadline with Confidence

Tax Deadline Looms: Are You Ready? The Race Against Time for Taxpayers!

For many taxpayers, the answer isn’t always clear, and with the tax deadlines looming, the pressure can quickly mount. But fear not, because understanding the tax calendar and the last day to file taxes is easier than you might think. From personal tax returns to business filing, there are a variety of due dates to keep in mind, each with its unique set of rules and regulations. Continue reading if you are unsure about when to file. We will walk you through everything you need to know about the income tax return filing deadline and help you stay on top of your tax game.

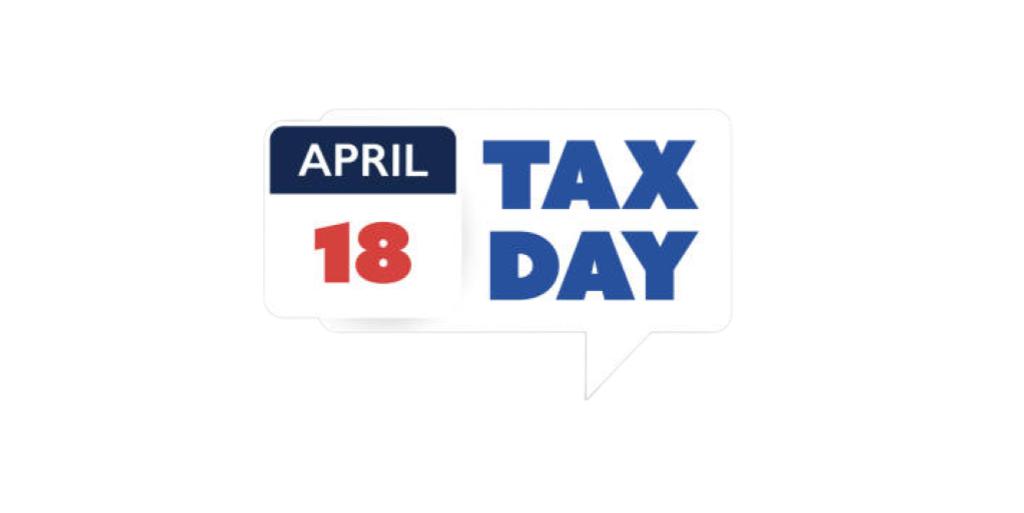

Normally, the deadline to file taxes is usually set for April 15 of each year. However, for this year the date has been extended to 18th April 2023 because the expected date falls on a weekend. Furthermore, Emancipation Day is observed on Monday the 17th of April.

If you are still contemplating whether you would be ready to file your taxes on that particular date, then worry not. You can file for a tax deadline extension until the 16th of October 2023.

Please remember that the October tax deadline extension filed will only pertain to your tax returns. However, if you have dues that you owe, those must be paid within the stipulated date i.e., 18th of April 2023. You may be penalized for any unpaid balances with the authorities. Furthermore, you may be subject to paying interest as well.

April 18th, 2023 is not only the tax return deadline for certain taxpayers. Depending on the place of residence, it is possible that the specific state or local 2023 tax deadline could be uncommon or dissimilar from the one set by the federal government. In such as case, it is best to validate when you must file your returns and fulfill all tax obligations.

Income Tax Filing Deadline for Those Without Employers Withholding Taxes

Individuals who do not have employers to withhold their taxes such as freelancers, self-employed, and those people who have fluctuating income levels. However, these individuals still need to stay on top of the last date to file taxes and payments throughout the year. Without proper planning, it’s easy to fall behind on estimated tax payments, which can result in costly penalties and interest charges.

To avoid this, it’s crucial to estimate your income and expenses accurately and make quarterly tax payments within the stipulated tax deadline accordingly. This requires careful record-keeping and tracking of all income and expenses, including deductions and credits. It’s also important to stay up-to-date on changes to the tax code, as these can have a significant impact on your tax liability and estimated tax payments.

IRS Options to Make your Tax Filing a Smooth Process Before the Last date to File Taxes.

With the federal tax deadline fast approaching, taxpayers may feel a bit overwhelmed. However, to make things better for you, the Internal Revenue Service (IRS) has provided opportunities that you can follow to make the entire tax filing procedure seamless as possible. By following these options, you can ensure that you meet the tax deadline and avoid any unnecessary penalties or fees. So, let’s dive in and explore the steps you can take to make this tax season a breeze!

Tax planning and meeting tax return deadlines are crucial for all taxpayers —even for those who don’t submit tax documents. The IRS has developed a page dedicated entirely to taxpayers to prepare themselves for filing their returns. Moreover, to ensure that those eligible, receive credits, which they haven’t in the past, the IRS urges them to financially plan and fill in accurate details.

The IRS understands that the entire process of preparing and filing returns within the stipulated last day to file taxes can be overwhelming, especially for the elders. This is why to make the process smooth for them, they offer volunteer income tax assistance and tax counseling for the elderly.

- The free file service by the IRS is a tool that many taxpayers can take advantage of when preparing their tax papers. This online tool has all the guidance that you would require to prepare and submit your documents according to the IRS tax deadline dates. It is a free tool that you can use to file your federal tax returns and it is safe and easy to use.

- If you wish to hire a tax professional to prepare your returns and file them within the estimated tax deadline, you can visit the IRS page on choosing a tax professional. This page has all the information that you would want when hiring a tax consultant. Besides this, the IRS can guide taxpayers to locate professional tax prepares in their locality and area, are recognized by them, and hold annual filing season program records of completion.

Crucial Dates for Estimated Deadline for Taxes

Federal or IRS tax filing deadlines are normally due fifteen days after the prior quarter. However, if the normal date falls on a holiday or a weekend, then the date for filing taxes is slightly extended. If you are planning to file your taxes it is important to keep the last filing dates for taxes in mind. Below is a table that will help you do so.

| Period of Income Earned | Tax Deadline Dates |

| 1st January — 31st March 2023 | 18th April 2023 |

| 1st April — 31st May 2023 | 15th June 2023 |

| 1st June — 31st August 2023 | 15th September 2023 |

| 1st September — 31st December | 16th January 2024 |

Please Note: For taxpayers who pay their annual tax returns by 31st January 2024, do not have to file or pay any estimated returns by 16th January 2024.

Know Your State’s Tax Deadline Dates

Most states are observing the 18th of April 2023 as the last date to file taxes. However, some states have been given exceptions and allowed an extension to file their tax returns. Below is the list of states who have been allotted extensions on their tax deadlines.

| State | Deadline for Filing Taxes 2023 |

| Iowa | May 1 |

| Virginia | May 1 |

| Delaware | May 2 |

| Louisiana | May 15 |

The State of California has given its resident tax deadline extension till May 18th, 2023. This is due to the state being heavily impacted by severe weather.

States that have no income taxes do not have to adhere to any deadline to file for taxes. These states include Alaska, Florida, Texas, Washington, South Dakota, Tennessee, New Hampshire, and Wyoming.

The Cost of Procrastination: Exploring the Consequences of Missing your Last Date to File Taxes

It is best not to procrastinate when dealing with tax-related matters. Taxpayers who do not have any liability or taxes owed to the IRS can file beyond the tax return deadline without any consequences. However, they might miss out on some credits or refunds applicable to them. So, filing within or before the due date with all accurate information and earnings can prove to be beneficial, especially for self-employed taxpayers.

On the other hand, if you do owe the government any taxes, you are in for a surprise as you might be fined or penalized for not paying within the stipulated IRS tax deadlines. If you have any unpaid taxes, you will be fined 5% of the equal amount that you need to reimburse. This will continue for each month if you have not paid for up to five months.

In case of a delayed return, that is 60 days (or 2 months) beyond the income tax deadline, a penalty will be levied which can be 100% of taxes owed. For taxpayers failing to pay, the penalty charges would be about 0.5% of the amount owed which can go up to 25% of the unpaid balance. Combining both, that is failure to file and pay will be equivalent to 5%.

Apart from the above charges, the IRS can levy additional interest on the uncleared tax balance if not filed within the tax deadline 2023. The interest rate may vary, but it is set at 3% plus the federal short-term rate. It is crucial to note that the interest is compounded daily, starting from the time the taxes are owed until its repaid in full.

Penalties for state and local missing tax payment deadlines may vary, so taxpayers must verify all information if filing their returns on a later date than the one originally set.

Best IRS Methods to File Your Taxes on Time and Before the Last Date to File Taxes.

Taxpayers have several options when it comes to filing their returns and meeting the deadline for the last date to file taxes. From the DIY method to hiring a tax expert to help prepare the tax documents. Check out some of the best IRS methods to file your return and complete all formalities before the income tax return filing deadline.

No matter what method you choose to file your return, you have to keep in mind that you must be ready with all the essential paperwork. This may include W2 forms for income earned as an employee, 1099s and 1099 INTs for income earned but not as an employee, charitable donation receipts, expenses incurred for medical reasons, and business expenses that you want to deduct. Once you have all documents prepared and in hand, you can now proceed with the best methods to file your taxes smoothly and meet the tax deadline.

E-filing

This is the most popular method of filing taxes because it is fast, accurate, and secure. Taxpayers can use tax software or online services to prepare and file their tax returns electronically to meet the tax year deadline. E-filing also allows for faster refunds, usually within a few weeks of filing.

File by Regular Mail

Taxpayers who prefer to file by mail can do so by filling out a paper tax return and mailing it to the appropriate IRS office much before the last date to file taxes. However, this method can take longer than e-filing and may delay the processing of the tax return.

Hire a Tax Preparer:

Hiring the services of a tax preparer can help taxpayer to efficiently file their taxes. Tax professionals can prepare and file tax returns on behalf of their clients with the IRS tax deadlines and can also provide tax planning advice.

Request Tax Extension:

If you have failed to pay your taxes by the deadline, you can request an extension to file the same. The tax extension deadline gives you another 6 months to submit your returns. However, please note that if you have any prior taxes owed you must pay them within the original date of filing taxes.

Don’t Wait Until the Last Minute: Meet the IRS Tax Deadline with Confidence

As the last date for filing taxes approaches, it is important to take action to ensure that your taxes are filed correctly and on time. Whether you choose to e-file, file by mail, use a tax expert, or request an extension, there are several methods available to help you meet the IRS tax deadline.

Filing your taxes on time is not only a legal obligation, but it also ensures that you avoid penalties and interest charges that can add up quickly for not meeting the income tax return filing deadline. By staying organized and taking advantage of the many resources available, you can make the tax filing process smoother and less stressful.

Remember, it’s never too early to start preparing for next year’s tax season to meet the deadline for taxes. Keeping accurate records throughout the year and staying up-to-date on changes to tax laws can help you stay ahead of the game and avoid any last-minute surprises. So don’t wait until the last minute – take control of your taxes today and file with confidence!

Frequently Asked Questions

The tax deadline is April 18th, 2023 because the original date falls on a weekend. Emancipation Day is observed on Monday.

The last date to file taxes is Tuesday, April 18th, 2023

If you miss the tax deadline, you may be subject to penalties and interest charges.

Yes, you can still file your returns after the deadline.

If you are unable to pay your taxes within the timeframe, you can request a tax extension deadline. This only works for your returns and not any taxes owed.

You can fill the form 4868 to extend your tax deadline.

It is the deadline to claim any ERTC credit for a specific period.

5% of unpaid taxes and a maximum of up to 25% every month of unpaid taxes.

April 18th, 2023

The tax deadline is extended in the State of California due to severe weather conditions.