QuickBooks has established itself as one of the most dependable accounting software products. This particular cutting edge has shown to be beneficial to large corporations, medium-sized enterprises, and small businesses. As a business owner, you can effortlessly manage your accounts and money. With its comprehensive capabilities, QuickBooks can make it simple for you to keep up with the bookkeeping process. The integrated functions in this QuickBooks program can help you prepare bills and invoices.

This tool may also be used to manage calculations, taxes, and payroll. Another unique feature of QuickBooks is the ability to manage your Accounts Payable. Accounts payable is the amount owed by your company to its creditors and suppliers. However, some customers may become confused if the application displays a negative opening balance in QuickBooks.

What Does a Negative Account Payable in QuickBooks Indicate?

When your organization has paid off more than what is necessary, you may have a negative liability on your balance sheet. Due to the underlying inaccuracy, the negative accounts payable in QuickBooks might sometimes also show as minus balance. There is a chance that you input the erroneous bills or wrote cheques against the current invoices. However, the original bills could not be discovered for some reason and appear to have been erased.

Several users may see this issue while registering a balance in QuickBooks Online. As a result, these consumers may discover that their amount does not match their QB accounts online. There might be several reasons why the bank balance does not match the application online balance. Another possibility is that your accounting software causes the program to freeze. It is necessary to know how to unfreeze the QB if you encounter a problem while working seamlessly.

After depositing your check into QuickBooks online, you deducted it from QuickBooks’s registered bank account. However, if you have not cleared the transaction with the bank, the following causes will be to blame for the error showing QuickBooks balance negative.

- Transactions were incorrectly entered into your QuickBooks register.

- The disparity can be caused by editing or deleting certain transactions from the bookkeeping records.

What Should be Done to Avoid a Negative Account Payable in QuickBooks?

If QuickBooks displays a negative account payable or any of the listed suppliers displays a negative balance in the vendor list, users should take the following actions to address the issue:

Bill Enter

- Navigate to the ‘Reports’ menu.

- Select the ‘Vendors & Payables’ tab.

- You must now choose the ‘Unpaid Bills’ tab.

- When you click it, a complete report will appear on your screen.

- At this point, you should carefully examine the report for any negative figures.

- If you do find any, you must double-click on it.

- On your computer screen, a bill payment check will be shown.

- Then go to the lowest section of the screen.

- There will be no bill presented.

- If you are unable to locate any amount of this check’s relationship to any bill.

- Please keep this tab open.

- Navigate to the ‘Vendors’ menu.

- Select the ‘Enter Bills’ option.

On the enter bill option, you should enter a bill to the vendor that was shown on the previous screen.

Note: You must ensure that the amount is similar to the one on the bill and as written on the check.

- You may also refer to the original bill and try to enter the precise date and other details from the original bill into the new bill.

- Then you must thoroughly check every piece of information.

- Then press the ‘Save’ button.

If you want to add more bills, select the ‘New’ action option. Otherwise, you can complete inputting the bills by clicking on the ‘Close action tab’ button.

- After completing the first four steps outlined above, you can return to the previous window of the bill payment check. The bill amount will then be displayed in the lower section of the screen.

- If you discover the bill in its proper position, check the box next to it.

- Then you must input the exact amount as it appears on the check.

- Choose ‘Save’ and then the ‘Close’ button.

- Then, by selecting ‘Yes,’ you should confirm the updated QuickBooks transaction adjustments.

- Navigate to the “Unpaid Bills Details” report.

- Select the ‘Refresh’ option.

The bill payment check will no longer be present, which was the reason for the negative account payable in QuickBooks.

- You must choose the Yes button.

- Navigate to the page Unpaid Bills Detail Report.

- The final step is to reload the page.

How to Troubleshoot a Negative Accounts Receivable in QuickBooks?

To eliminate the problem of negative accounts receivable in QuickBooks showing on the balance sheet, make the following changes:

- Find the Customer Payment Window.

- Locate the checkbox that says “This is a customer prepayment”.

- If this option is selected, the program will credit another Current Liability account associated with the client rather than Accounts Receivable.

- When the user is ready to create an invoice, QuickBooks will provide the option of accepting prepayment in the Apply Credit Window.

- If the user selects pre-payment, the program will debit the other current liability account and credit the linked customer’s A/R account.

The above-mentioned steps will maintain the balance sheet clear to identify clients with customer prepayments and make it easier to use Customer Payment windows. As a result, there is no need to hire a third party to identify the negative account receivable conflicts that frequently occur when using the balance sheet.

Conclusion

The reason users face the problem with negative open balance in QuickBooks is that they sometimes forget to check the double entry in the software. Therefore, if you want to avoid negative accounts payable and receivable you must check to see if payment has not been paid towards a particular bill twice. The above steps mentioned here are to provide you with a resolution to ensure that this error does not appear.

Frequently Asked Questions

Any negative amount in the account payable indicates that bills were appropriately recorded and checks were sent against those bills. However, the initial bills were wiped or deleted accidentally, resulting in the user displaying a negative account due.

Yes, you can use the following methods to do this:

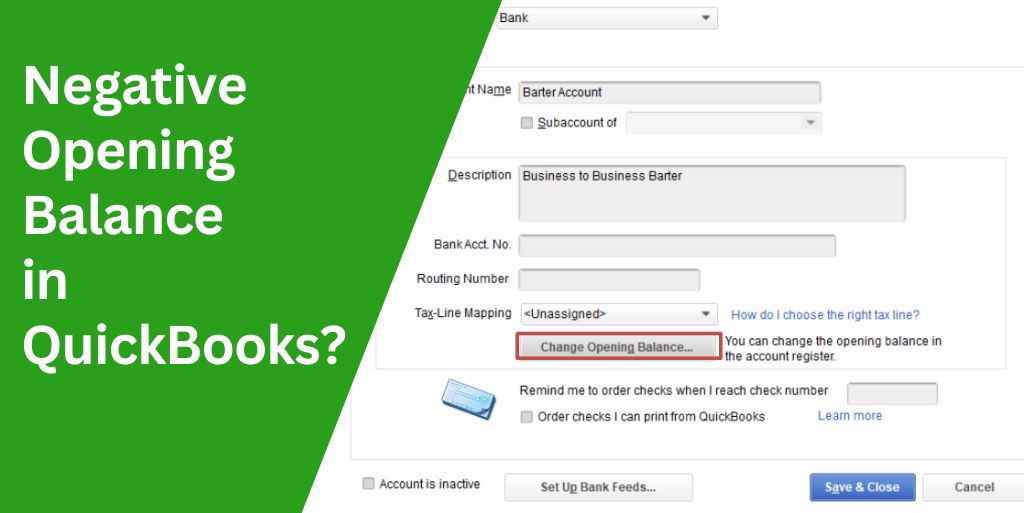

· Navigate to the QuickBooks Company tab.

· Then click the Make General Journal Entries button.

· Identify the journal entry you prepared.

· After that, you can change the date to the first day of the following quarter.

· When prompted, save your changes and click the No option.

· On the top of the Journal Entry window, click Reverse.